Bank Marketing Strategy

Digital marketing is crucial for banks and credit unions. Historically, many banks have underinvested in digital marketing, often adhering to traditional norms and strategies like newspaper ads and billboards. It is past time to acknowledge the escalating significance of digital marketing and allocate a larger segment of the budget towards it. Continue reading to uncover the transformative power of digital marketing in the banking sector and learn how your institution can harness its myriad of opportunities effectively.

>> Skip to Budget Calculator

The Unparalleled Importance of Digital Marketing

The importance of digital marketing cannot be overstated. The digital realm has become an integral part of our daily lives, influencing everything from our shopping habits to our banking preferences. For community banks, understanding and leveraging this digital shift is not just an option; it’s a necessity.

Evidence of the Digital Shift:

Recent studies have shown a significant increase in the average daily time spent on the internet. In 2022, the average American spent 7 hours online per day, a number that has been steadily rising year over year. This indicates that consumers are now more digitally inclined than ever before.

Banking Goes Digital:

The banking sector, traditionally seen as a brick-and-mortar industry, has not been immune to this shift. Online banking, mobile apps, and digital-only banks have seen a surge in popularity. For instance, a survey conducted in 2023 revealed that 87% of Americans used mobile banking apps at least once a month. This digital adoption is not limited to the younger generation; even older demographics are embracing online banking, showcasing the widespread acceptance of digital platforms.

For local community banks, this digital shift presents both a challenge and an opportunity. The challenge lies in adapting to this new landscape and ensuring that their services are in line with the digital expectations of their customers. The opportunity, however, is immense. By harnessing the power of digital marketing, community banks can reach a wider audience, offer personalized services, and compete effectively with larger banks and financial institutions.

Adapting to the New Era: The Shift from Traditional to Digital Marketing

The marketing landscape has undergone a seismic shift over the past few decades. While traditional marketing methods, such as print ads, billboards, and TV commercials, once dominated the scene, the advent of the internet and digital technologies has revolutionized the way businesses reach and engage with their customers.

The Rise of Digital Ad Spend:

The global digital ad spend has been on an upward trajectory, with projections indicating a significant surge in the coming years. In 2022, digital ad spending worldwide surpassed $550 billion, a stark contrast to the $298 billion spent on traditional advertising. This trend is expected to continue, with digital ad spend projected to reach $668 billion by 2024. With consumers increasingly turning to online platforms, banks that fail to invest adequately in digital marketing risk being left behind.

The Digital Marketing Gap in Community Banks

Historically, technological prowess was the exclusive domain of the Big Banks, with tools like Online Account Opening (OAO), mobile apps, and advanced digital platforms being their unique selling propositions. However, the democratization of technology has leveled the playing field. Today, even the smallest local banks have access to these advanced tools. However, when it comes to digital marketing, many community banks lag behind. They rely too heavily on the traditional marketing channels of the past. It’s essential for community banks to recognize the immense potential of digital marketing and invest in it proactively. By doing so, they can ensure they not only keep pace with larger institutions but also carve a niche for themselves in this digital age.

Impact and Insight: A Metric-Driven Exploration of Marketing Results

As technology advances and consumer behavior evolves, the scales are tipping heavily in favor of digital marketing. One of the most compelling reasons for this shift is the unparalleled measurability and analytics that digital platforms offer.

The Limitations of Traditional Marketing:

Traditional marketing methods, such as billboards, print ads, radio spots, and TV commercials, have been staples in the advertising world for decades. While they can be effective in building brand awareness, their most significant limitation is the lack of precise measurability.

If your bank invests in a billboard on a busy highway, there’s no accurate way to determine how many people saw the advertisement, let alone how many took action based on it. Placing an ad in a magazine might give you circulation numbers, but there’s no concrete data on how many readers noticed your ad or were influenced by it.

“Ad waste is an ongoing problem with analog channels,” said Tim Davis, MBA, the digital marketing team manager at BankBound. “Shift to an in-bound marketing mindset and deliver helpful information to people when they seek it, not when you feel like saying it. In the case of billboards, consider how many people drive by your HELOC ad do not own property or who are not in-market for your solution. Your ad dollars are wasted on each of them. Yes, executing multiple touchpoints is important to the sales process, but it starts with recognizing user intent and providing education.”

The Power of Digital Analytics:

Contrast this with digital marketing, where every click, view, and interaction are trackable. Digital platforms provide businesses with detailed analytics that offer insights into:

- Reach: How many people saw your ad or content.

- Engagement: How many interacted with it, be it through likes, shares, comments, or clicks.

- Conversion: How many took the desired action, such as signing up for a newsletter, downloading an app, or making a purchase.

- Customer Journey: Track a customer’s path, from the first interaction with your brand to the final conversion, understanding touchpoints and influences along the way.

Real-world Example of Digital Marketing’s Benefit:

Imagine a community bank launches a new savings account product. They decide to promote it using both traditional (a local newspaper ad) and digital (a targeted Google Ads campaign) channels. At the end of the month, the bank might know how many new accounts were opened but would struggle to attribute these directly to the newspaper ad. On the other hand, the Google Ads campaign would provide detailed metrics on how many people saw the ad, clicked on it, visited the website, and eventually opened an account. This level of detail allows for accurate ROI calculations and strategy optimizations. With digital marketing’s detailed analytics, banks can make data-driven decisions, refine their strategies based on real-world feedback, and ensure that their marketing budget delivers maximum impact.

Strategize to Optimize: Essential Recommendations for Digital Marketing

The digital landscape offers a plethora of opportunities, but to harness its full potential, banks need to approach it with a well-thought-out strategy. Here’s a deeper dive into the recommendations for crafting a successful digital strategy:

Allocate Adequately:

The marketing budget allocation should be a reflection of the bank’s goals. A study found that successful companies allocate about 12.1% of their revenues to marketing, with a significant chunk dedicated to digital channels. For those aiming to broaden their reach, an even larger budget might be necessary to successfully enter new markets and attract more customers.

Diversify Marketing Channels:

Relying on a single digital channel is a risky strategy. A multi-channel approach ensures that the bank reaches its audience wherever they are, be it on search engines, social media platforms, or email.

SEO (Search Engine Optimization):

SEO is the practice of optimizing a website to rank higher on search engines like Google. By using specific keywords, producing high-quality content, and ensuring a user-friendly website experience, businesses can attract organic (non-paid) traffic to their site.

PPC (Pay-per-click):

PPC is a form of online advertising where advertisers pay a fee each time their ad is clicked. It’s a way of buying visits to your site, rather than attempting to earn those visits organically. Text, graphics and video are all common methods of PPC ads.

SMM (Social Media Marketing):

SMM involves creating and sharing content on social media platforms. This includes posting text and image updates, videos, and other content that drives audience engagement.

Email Marketing:

Email marketing is one of the most direct and effective ways to connect with leads, nurture them, and turn them into customers. It involves sending emails to prospective or current customers.

Content Marketing:

Content marketing Focused on creating and distributing valuable, relevant, and consistent content like blogs, guides and how-to videos to attract and retain a clearly defined audience.

Staff and Employees

This includes hiring, training, and developing employees. Employees who are spread too thin may not efficiently complete tasks, resulting in poor performance and potentially hindering the overall strategy.

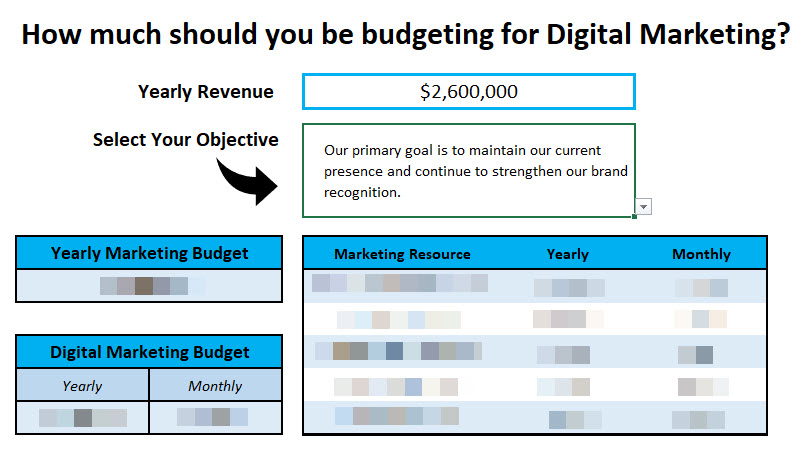

Use Our Free Digital Marketing Budget Calculator Tool: Tailored for Banks and Credit Unions

Our free calculator tool is not just another generic budgeting tool. It’s tailored specifically for banks and credit unions. We’ve designed it keeping in mind the unique needs and challenges of the banking sector. Whether you’re new to digital marketing or haven’t revisited your marketing strategy in a while, this tool is here to guide you. By inputting your organizations total yearly revenue, our calculator provides a detailed breakdown of how much you should be spending on digital marketing by channel. The recommendations are based on industry benchmarks, current digital trends, and our extensive experience in serving banks and credit unions.

Download Our Free Digital Marketing Budget Calculator:

Take Control of Your Digital Marketing Strategy with BankBound

Technology has reshaped how banks and credit unions engage with customers. In this ever-changing landscape, it’s vital for community banks to leverage digital marketing to stay competitive. This article highlights the increasingly critical role of digital marketing, the shortcomings of traditional marketing, and the abundant opportunities provided by a thoughtfully devised digital strategy. However, recognizing its importance is only the initial step. The real challenges emerge during implementation and optimization. That’s where BankBound comes in. With our specialization in serving banks and credit unions, we bring a wealth of knowledge, insights, and tailored solutions to the table. Our free Digital Marketing Budget Calculator is a testament to our commitment to helping our clients succeed.