Bank Marketing Strategy

It was a good run.

Residential mortgages, mortgage refinance loans, HELOCs, and personal loans have been major revenue drivers for financial institutions across the country for the past few years.

Let us wax poetic for a moment.

Bankers were achieving their goals and enjoying performance bonuses. Interest rates were low and home prices were high. Application volume was limited only by the existing home inventory and new home starts. Rinse. Wash. Repeat.

Home sellers had been loving the soaring home values. Sky-high appreciation! Home buyers, while not loving the higher home prices, were content with financing the elevated costs with the classic 30-year mortgage. Hello, closing cost fee income! Mortgage rates were low. Inflation was low. Household income was up and so too were personal deposit levels.

Banks had been enjoying elevated capital ratios and a sizable interest rate spread. CFOs were sleeping well at night. It felt great to utter the words: “we don’t need deposits.”

You may have noticed a lack of stats above. You do not need me to tell you the numbers – you lived it. It was great, until it was not.

The National Association of Realtors (NAR) has reported that, as compared to the previous year, “single-family home prices [were] up 20.6% in March 2022.” Combine that detail with the reality of 5.00%+ mortgage rates and you find yourself with a front-row ticket for a heavyweight match between home buyers and sellers – supply v demand. If rates remain elevated and at a slightly upward trajectory, which seems likely for at least the next couple of years, sellers will have no choice but to drop their prices. We are beginning to see that play out, although slowly.

In April, Morgan Stanley published an article about the yield curve. Therein, U.S. Chief Economist Ellen Zentner offered her view of what the shape of the yield curve means, given other economic indicators. Her opinion adds credence to BankBound’s view of where opportunities lay for bank marketers.

Zentner was quoted as saying “… when we look at factors in the economy that are typically signals of a recession, such as job growth, retail sales, real disposable income and industrial production, we don’t see an approaching recession.”

Recommendations for bank marketers for 2022 and 2023:

Build Your Moat and Make it Sticky

The goal of the proverbial moat is not to keep anyone out but, instead, to prevent customers from leaving. The moat represents your efforts to incentivize or otherwise provide strategically designed benefits to make leaving your financial brand less easy or convenient. In other words: remove friction for those coming in but build in friction as a function of leaving.

- Offer to rebate foreign ATM fees up to specified dollar amount each month. This would allow your customers to use any ATM, not just those in a specific network. With ATM use decreasing slowly over time, you may find that offering rebates for actual foreign ATM use is less expensive than locking your financial brand into a lengthy contract with a third-party network. This removes the friction of customers have to know which ATMs are in (or not in) your ATM network. Find additional ideas on effective ATM promotions and marketing.

- Direct deposit of payroll: Switching one’s direct deposit selection from one financial brand to another takes effort – and there is probably a form involved. Incentivize new and existing clients to establish a direct deposit from their employer and you will likely see a decrease in account attrition over time. Remove the friction: create a downloadable fillable PDF of a bank-branded direct deposit setup form and make it available via email and your website.

- Offer a loan rate discount to commercial lending clients who hold the loan amount on deposit with your financial brand.

- Commercial online banking with remote deposit capture: provide this for free to commercial loan clients who maintain an active business checking account. Yes, free. Any customer who leaves your financial brand will be charged fees at most other institutions.

- Consumer online bill pay: The stickiest feature of them all! Setting up payees in online banking takes time. Switching to another bank and setting up payees (again) is nobody’s idea of fun. For existing clients, use email marketing and statement inserts to promote online bill pay. For new and existing clients, offer to set up their payees for them. Remove the friction that is preventing them from establishing your bank or credit union as their primary banking relationship.

Did you know that BankBound can function as your outsourced chief marketing officer (CMO)? Contact BankBound to discuss your marketing priorities.

Keep your deposit rates competitive

For consumers, shopping around and comparing deposit rates has never been easier. If your base-level deposit rate is not competitive, you are inviting them to take their money elsewhere. This is especially true when consumers are keenly aware that banks are raising rates.

There are two typical ways that consumer deposit rates could be adjusted in a rising-rate environment.

The first approach is to leave rates as-is for your current deposit products, and launch a new titanium, zinc, or other fancifully named deposit account for “new customers only” that features a higher APY. This approach takes into consideration that your CFO, CEO, and rate committee do not want to re-write the bank’s book of business. We get it; but do you know who also gets it and not like it? Your existing clients. What message does this send to your current customers? How does having four or five different checking accounts affect in-market consumer purchasing decisions?

We covered the Paradox of Choice and ways to simplify your financial brand’s efficiency ratio in a previous guest post. Check that out if you can.

Option two is where you increase the deposit rates of your existing consumer products to remain competitive. Increasing your deposit rates will keep your current clients happy and open the door for cross-selling opportunities.

Focus on Fee Income

Zentner mentioned four notable areas of our economy that are showing resiliency – “job growth, retail sales, real disposable income and industrial production.” For bank marketers, we feel this translates to fee income as a major opportunity for clients.

Fee income from debit and credit cards

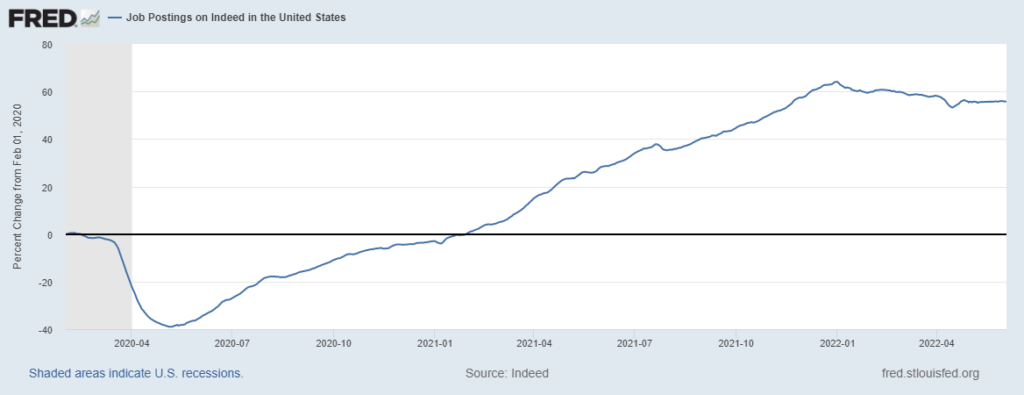

According to data from the Federal Reserve Bank of St. Louis, as of June 3, 2022, postings on job board Indeed are up 56 percent since the COVID-low on May 4 of 2020. At the end of March and April 2022, the seasonally adjusted unemployment rate held steady at 3.6 percent. Finally, consumer spending is also riding high. Personal Consumption Expenditures are 13 percent above pre-pandemic levels. The takeaway here is that few people are unemployed, and they are continuing to spend. A focus on increasing the adoption rate of your financial brand’s debit and credit cards could translate into increased and consistent interchange fee income.

Wealth management fee income

According to How America Banks, a 2019 survey by the FDIC (updated in 2021), “97.3 percent [of respondents] were very or somewhat satisfied with their primary bank.” This supports what we see in our client work. While there certainly are opportunities to capture market share when consumers are seeking a new primary bank, a larger opportunity may lay with your current customers. A combination of digital marketing and person-to-person outreach is a winning solution. By leveraging your in-house data and the expertise of your digital marketing agency, you could identify current clients who may be thinking about wealth management, estate planning, or trust administration.

Foreign currency exchange fee income

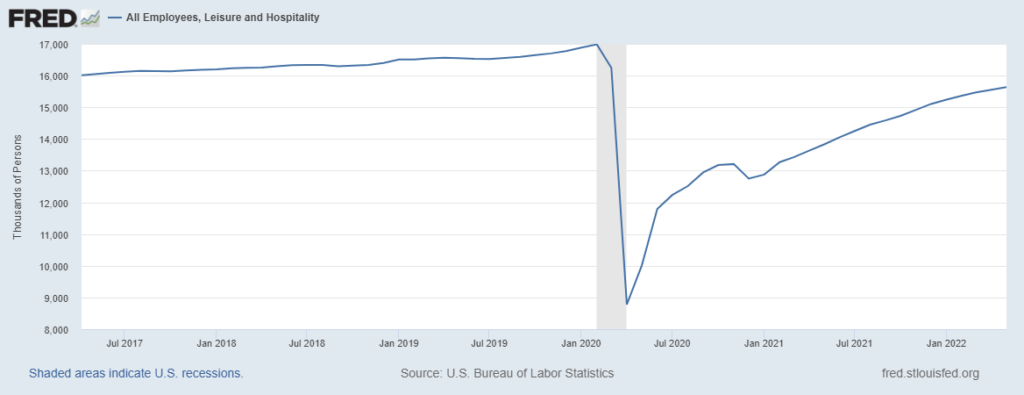

In of May 2022, the number of employees in the leisure and hospitality sector stood at 15.7 million, up 44% from the pandemic low. This indicates confidence within the travel industry that there is pent-up demand for travel. As of June 12, the CDC will no longer require passengers traveling from abroad to show a negative COVID-19 test before departing for the U.S. This could provide a lift for the sector by encouraging international travel by U.S. citizens. We see this as an opportunity to market foreign currency exchange services, in addition to the benefits of using a credit card while abroad.

Fee-based business services

Your small business clients are on the receiving end of robust consumer spending. How many of your business deposit clients are also finding operational efficiency with your cash management services? A deep dive into your core banking system or CRM should reveal opportunities for re-marketing, marketing automation, and personal outreach. Look for fee income-generating opportunities related to:

- Merchant services

- Remote deposit capture

- Lock box services

- Night depository – are you charging enough for this labor-intensive service?

- ACH and positive pay

- Commercial online banking

Are you interested in identifying and capitalizing on fee income opportunities among your current customers? Contact BankBound, a digital marketing agency focused on the financial services industry. BankBound can support or lead your financial brand’s marketing efforts though PPC, SEO, content marketing, and marketing automation.