Use these proven marketing strategies to reach the right audience and increase deposit account growth.

According to a recent report from CommunityBanking.org, “Nearly one-third of bankers ranked either core deposit growth or the cost of funds as their greatest challenge.” Additional reports from BAI, KPMG, correspondent banks, and other banking industry pundits all echo the same sentiment. Of the many banks we support with digital marketing solutions here at BankBound, growing consumer and business deposits was a top priority for most banks in 2024 and continues to be a focus in 2025.

As the war for deposits continues to accelerate, community banks and credit unions must deploy more effective financial marketing strategies to sustain deposit growth.

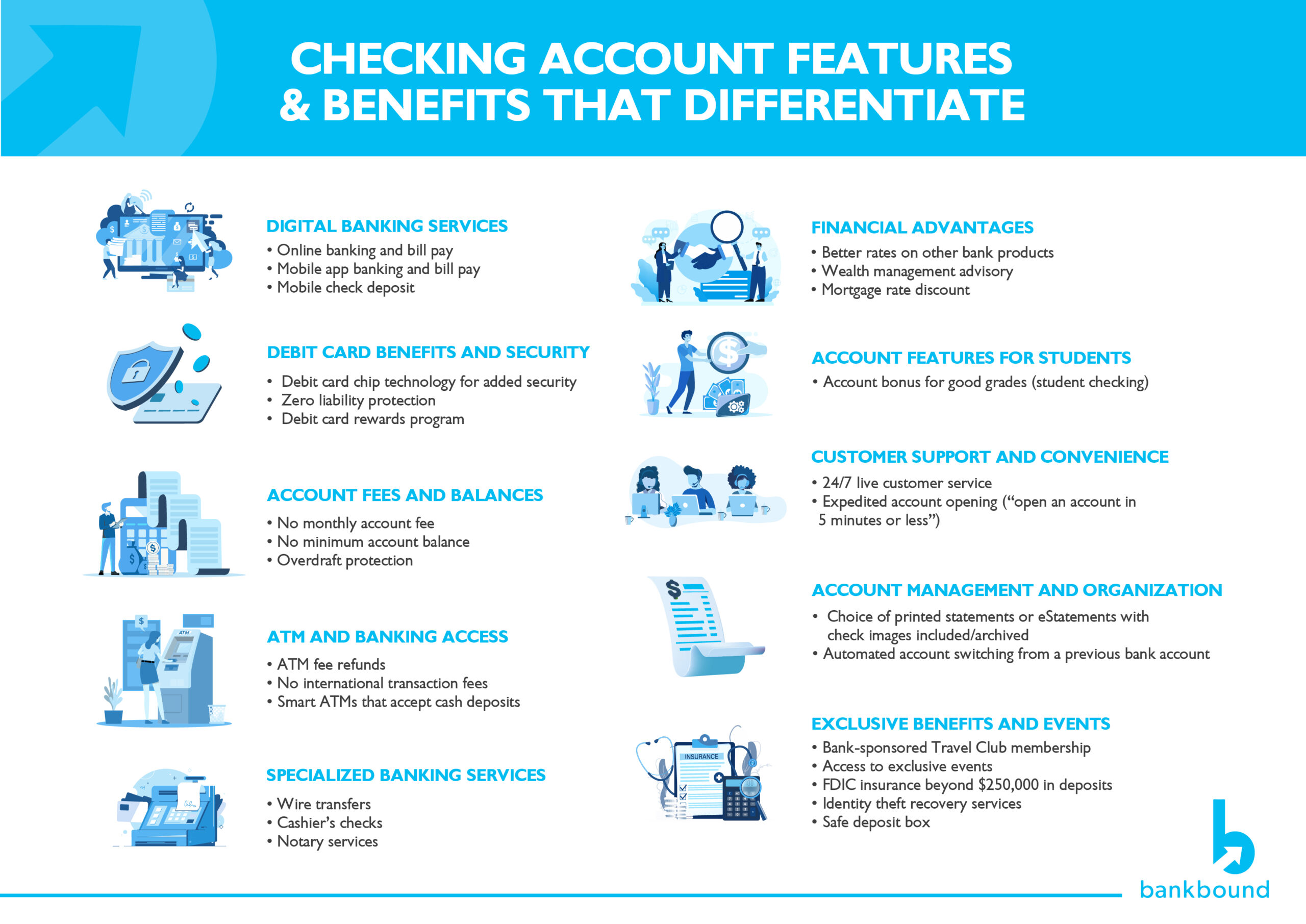

This guide details 7 deposit marketing strategies for increasing core deposits from existing and prospective bank customers. At the end of the article you’ll also find a long list of related deposit promotions and examples of differentiating deposit product features and benefits—even digital banks have discovered that rate alone is not a winning deposit acquisition strategy.

1. Know Your Target Audience

The average American’s banking behavior and expectations of their bank have changed rapidly in recent years. At least for transactional banking purposes, many customers can’t remember the last time they walked into a physical bank branch office. Consumers are more than familiar with the constant marketing efforts (and negative headlines) of megabank brands and are now also bombarded with options from banks who have launched digital brands, fintechs, and embedded banking within popular non-financial platforms. Community financial institutions often lack brand recognition even in their own local markets and struggle remaining relevant with younger demographics who often are unfamiliar with traditional banking products like the certificate of deposit.

Given these industry changes (and many more), local banks must adapt their business model to remain relevant:

- In-person service should match digital service.

- Banker’s hours are not best for business.

- Your digital banking experience must differentiate.

Investment in better partners, people, and technology will be required.

2. Leverage Just-In-Time Branding

According to the CA Web Stress Index, 88% of consumers will shop online first before opening a checking account. Even the majority of people who decide to open an account at a physical branch gather information online first. You may be the closest financial institution, and you may have the best rates for your deposit accounts, but if your competitors are dominating the top organic and paid positions in Google and Bing search results and AI, then you are missing out on new customers. Are your prospective customers even aware your bank exists?

Local SEO (search engine optimization) is the key to maximizing your online visibility for each of your branches along with individual products, people, and industry specializations. Many elements play a role in creating a comprehensive local SEO strategy, but here are some essential strategies that you can use to get in front of your potential customers:

- Local Map Listings: Create and verify online listings for each of your branches in Google, Bing, Apple, and other credible business directories. This information typically appears above organic results when a local search is performed and provides a breakdown of the essential information that your customers need most: branch address, hours of operation, phone number, a link to your website, and directions to lead them right to your door. Earning 5-star reviews for these listings will increase your credibility, giving potential customers a greater sense of confidence that you will be able to help them.

- City-Specific Content: Create pages on your website for each of your bank’s branches. Flesh them out with contact information for the branch, a high-quality image of the building, and the address. Don’t forget to add a few paragraphs of unique content that describe the services you offer, your staff, etc. These elements work together to help each branch location page rank higher in the search engine results.

- Content Marketing: Creating content that is of interest to your target audience is an effective way to accelerate engagement with both prospects and existing customers while naturally introducing your brand, products, and people. While there are only so many people in your market searching for checking and savings account options, nearly everyone searches online for answers to financial questions or to discover relevant resources for their life or business.

People in your target market are searching online every single day for the products, services, and expertise that your FI offers. Will they find you, or a competitor?

3. Play Offense To Win

Most banks make sure to budget for local advertising and community sponsorships each year, but are your paid efforts actually measurable? Traditional channels such as TV, radio, newspaper, magazines and others typically can’t be measured. Is that “branding” or “awareness” budget really well spent? No one really knows.

For a measurable impact, accelerate marketing investment into digital advertising. Unfortunately, as most financial institutions have shifted traditional advertising dollars into digital channels, marketing attribution is still a major problem. We often find banks of all sizes investing in Meta/Facebook/Instagram Ads, Google Ads, YouTube Ads, Programmatic Ads, Geofencing Ads and more without any meaningful conversion tracking configured. A successful digital advertising strategy requires continuous investment in data analytics.

Asking for additional advertising budget is a lot easier when campaigns can be directly attributed to new deposit accounts.

4. Differentiate Your Digital Banking

As we head deeper into 2025, few things are certain. However, you can count on your customers and prospects spending more time on their mobile phones than ever. Your digital banking experience is now a big part of how users perceive your financial brand. For digital banks, the digital banking experience is the brand.

Unfortunately/fortunately, a study by Forrester found just 36% of US banking customers think their primary bank’s app offers unique value that’s different from others. Offering a feature rich app with relevant personal financial management (PFM) tools, actionable insights, and useful integrations is a compelling win theme for deposit acquisition.

Read more about how to promote your mobile banking app.

5. Be Boring (In a Good Way)

In the wake of recent bank failures, promoting your financial institution’s participation in ICS®, the IntraFi Cash Service®, and CDARS® can help you attract risk-averse customers and increase overall deposit value. Target both current and prospective customers with the promise of accessing millions in FDIC insurance through demand deposit market accounts, money market accounts, and CDs.

If your bank can help people with large bank deposits keep their money insured, make sure you are promoting it to prospective customers and especially to existing customers. Most of your customers have (multiple) deposit accounts with other financial institutions. Help them consolidate their financial life with your institution.

6. Remove Account Opening Friction & Fraud

Both consumers and businesses increasingly prefer to open deposit accounts online, but they have expectations. Does your bank’s digital account opening experience offer the following?

- Mobile-first, intuitive design.

- Ability to fund an account with a debit card, credit card, or direct transfer from another financial institution.

- Ability to remove tedious identification methods from the application.

- Ability to complete the application in less than 5 minutes.

- Automated identity decisioning to mitigate complex fraud.

- Single platform that applicants, in-branch employees, and your call center can all work from.

- Email automation to help applicants return to an incomplete application.

Simply launching digital account opening does not guarantee deposits. It’s critical to invest in online account opening software that will delight your applicants with a frictionless user experience while tirelessly combating fraud.

7. Branch Out (Online)

While they may not be aware of your brand or actively searching for your products, consumers spend a lot of time online seeking financial advice and best practices. Affiliate marketing allows your brand to place products directly into niche publishers who already have an established online following.

Most local financial institutions are not likely a fit for mega-affiliate sites like Bankrate and Nerdwallet, but there are many better (and more affordable) options for creating an affiliate program for deposit products.

Take the next step to increase deposit growth.

Do you need a partner that can execute your deposit growth strategy? BankBound works exclusively with financial institutions, using data-driven marketing to ensure the best possible ROI. Reach out to start a conversation to see how we can take your digital marketing results to the next level.